The steady and resilient Wireless Device Growth in a market that many consider mature is a testament to the technology's fundamental importance and its continuous evolution. While the days of explosive, double-digit annual growth in the smartphone market may be over in developed regions, the overall industry continues to expand due to a powerful combination of factors, including growth in emerging markets, the rise of new device categories, and consistent technological advancement. This sustained expansion is why the market's financial forecast remains so robust. The global Wireless Device Market size is projected to grow USD 2671.31 Billion by 2035 , exhibiting a CAGR of 3.96% during the forecast period 2025 - 2035. Understanding the key drivers behind this 3.96% CAGR is crucial to appreciating the long-term health and stability of this foundational technology sector.

The most significant driver of volume growth is the continued expansion of connectivity in emerging markets. In many parts of Africa, Southeast Asia, and Latin America, hundreds of millions of people are still coming online for the first time. For these users, an affordable smartphone is not just a communication device; it is their primary, and often only, gateway to the internet, financial services, education, and economic opportunity. As network infrastructure improves and the cost of entry-level smartphones continues to fall, this massive, untapped user base provides a long and powerful tailwind for market growth. This is where the battle for volume is being fought, with brands offering high-value features at low price points competing fiercely for these new digital citizens.

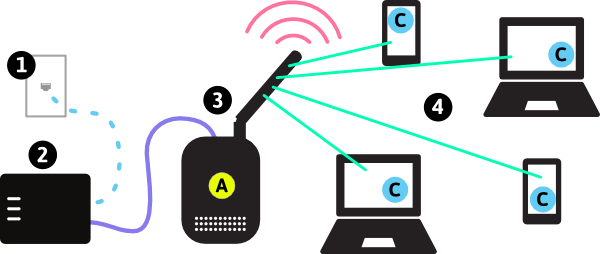

A second powerful driver of growth is the explosion of new device categories beyond the smartphone, primarily the Internet of Things (IoT) and wearables. The IoT represents a massive expansion of the market, as everyday objects—from home appliances and cars to factory machines and shipping containers—are being embedded with wireless connectivity. While the revenue from a single IoT sensor is small, the sheer scale of deployment, projected to be in the tens of billions of devices, creates a huge new market. Similarly, the wearables market, including smartwatches, fitness trackers, and hearables, is a major growth engine. As these devices become more sophisticated, particularly in their health monitoring capabilities, they are transitioning from being niche gadgets to essential wellness tools, driving strong consumer demand and a rapid upgrade cycle.

Finally, growth in mature markets is sustained by a constant cycle of technological innovation that encourages upgrades and maintains average selling prices (ASPs). The introduction of new network technologies like 5G and Wi-Fi 7 provides a compelling reason for consumers and businesses to purchase new devices. Breakthroughs in camera technology, display quality (e.g., higher refresh rates and foldable screens), and processing power are key marketing tools used to drive annual replacement cycles. Furthermore, the growth of the software and services ecosystem, where new apps and features require more powerful hardware to run effectively, also plays a crucial role in obsolescing older devices and encouraging consumers to upgrade to the latest models, ensuring a steady stream of revenue even in saturated markets.

Explore Our Latest Regional Trending Reports!

South America Wireless Telecommunication Service Market Size