Introduction

The evolution of the airport sleeping pods market isn’t just about more units—it’s about smarter units. From advanced materials to booking software, the industry is innovating to meet traveller demands for comfort, privacy and convenience.

Materials & Design Trends

One of the key segments in the market is material: plastic remains the largest material type, thanks to cost-efficiency and ease of installation. However, metal is the fastest-growing material segment, offering improved durability and premium appearance.

These material choices influence the size and footprint of pods (e.g., compact vs luxury), as well as maintenance and lifespan.

Design trends include sound-proofing, adjustable lighting, climate control and integrated booking/payment systems—features that reflect increasing traveler expectations around comfort and technology.

Service Models: From Pay-Per-Hour to Subscription

The service model is a key dimension of market segmentation. Currently, the pay-per-hour model holds the largest share—ideal for layovers and short rest periods. But membership plans and subscription models are growing fastest, targeting frequent travellers and loyalty programmes.

This shift has implications: airports and providers must invest in infrastructure, booking systems and customer experience to support recurring-revenue models. The industry is evolving from simple pods to lounge-style services with perks, access control and tiered pricing.

Business & Operational Impacts

From a provider’s standpoint: choosing the right material and service model is critical. Luxury pods built in metal with high-end amenities can justify premium pricing and appeal to business travellers. In contrast, plastic pods with basic features may serve high-volume budget markets.

Operationally, integration with airport systems (booking kiosks, mobile apps, access control) increases efficiency and enhances user experience. The use of technology also enables data collection (occupancy, usage patterns) that support optimised pricing and inventory management.

This level of analysis shows how innovation in materials and service models drives differentiation and market competitiveness.

Forecast & Trends

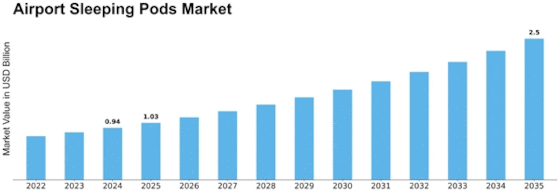

The Airport Sleeping Pods Market forecast (USD 1.027 billion in 2025 rising to USD 2.5 billion by 2035) indicates strong industry momentum. A key trend: premiumisation and service-model diversification will likely accelerate, meaning more pods with advanced features, higher price points and membership models.

Another trend: modular pods that allow faster deployment and scalability will become popular. Such pods might offer flexible layouts (single, double, family). As airports strive to enhance passenger experience, demand for smarter amenities will increase, promoting further growth.

Strategic Considerations

-

Material & design: selecting a balance between cost and premium feel.

-

Service model: defining the right mix (pay-per-hour for general traffic, subscription for business travellers).

-

Technology integration: booking, access, analytics.

-

Market positioning: premium vs budget offering, targeted by traveller type.

-

Scalability: design units to allow fleet expansion or upgrade.

Providers who align with these strategic levers will be better placed to exploit future opportunities.

Conclusion

The airport sleeping pods market is evolving beyond basic rest-units. It is now a smart convergence of design, technology and service innovation. By leveraging advanced materials, differentiated service models and integrated systems, the industry is shaping a more comfortable and efficient future of travel rest-spaces.

FAQs

Q1: What material type is dominating the sleeping pods market?

A1: Plastic is currently the largest material segment, but metal is the fastest-growing material type.

Q2: What service model holds the largest share today?

A2: The pay-per-hour model holds the largest share among service models.

Q3: Why are subscription/membership models gaining traction?

A3: Because frequent travellers and business passengers seek trusted, repeatable resting solutions, membership models provide convenience, loyalty benefits and often cost savings, making them attractive.